Saving money on car insurance is a top priority for most drivers. But cutting corners by sacrificing essential coverage can leave you vulnerable in case of an accident. Luckily, there are plenty of ways to lower your car insurance costs without losing coverage. This article will guide you through proven strategies to achieve just that. Let’s dive in and explore how you can keep more money in your pocket while staying protected on the road.

Smart Shopping: Finding the Best Deals

Comparing Quotes from Multiple Insurers

Don’t settle for the first quote you receive. Shopping around and comparing quotes from different insurance providers is essential. Each insurer uses its own formula for calculating premiums, so prices can vary significantly. Get quotes from at least three to five different companies to get a clear picture of the market. You can use online comparison tools or contact insurers directly.

Comparing quotes allows you to see which company offers the best balance of price and coverage. Pay attention to the specific coverage options included in each quote, ensuring they meet your needs. Remember, the cheapest option isn’t always the best if it lacks crucial coverage.

Bundling Insurance Policies

Many insurance companies offer discounts for bundling different policies, such as auto and home insurance. By insuring your car and home with the same company, you can often save a significant amount on both premiums. This can be a great way to streamline your insurance management while enjoying lower costs.

Explore bundling options with your current insurer or inquire about discounts when getting quotes from new companies. Even a small percentage discount on each policy can add up to substantial savings over time. This is a practical approach on how to lower your car insurance costs without losing coverage.

Taking Advantage of Discounts

Insurance companies offer a variety of discounts, so it’s important to ask about them. These discounts can range from good student discounts for young drivers to safe driver discounts for those with clean driving records. Some companies even offer discounts for bundling policies, having multiple vehicles insured, or installing anti-theft devices.

Don’t be shy about asking your insurer or potential insurers about all available discounts. You might be surprised at the savings you can unlock by simply inquiring. Every little bit helps when it comes to reducing your car insurance premiums.

Optimizing Your Coverage for Savings

Choosing the Right Deductible

Your deductible is the amount you pay out-of-pocket before your insurance kicks in after an accident. Choosing a higher deductible can significantly lower your premium, but it also means you’ll pay more if you file a claim. Carefully consider your financial situation and risk tolerance when selecting a deductible.

Find a balance that allows you to save on premiums while still being able to afford the deductible if needed. If you have a solid emergency fund, you may be more comfortable with a higher deductible. However, if you’re on a tight budget, a lower deductible might be a better choice.

Evaluating Your Coverage Needs

Take the time to review your current coverage levels and ensure they align with your needs. Do you really need comprehensive and collision coverage on an older vehicle with low market value? Adjusting your coverage can help lower your premiums.

Consider dropping collision and comprehensive coverage if your car’s value is less than ten times the annual premium. However, liability coverage is essential and should not be compromised. Carefully assess your situation and determine the optimal coverage levels to maintain adequate protection while minimizing costs, achieving how to lower your car insurance costs without losing coverage.

Maintaining a Clean Driving Record

Your driving record is a major factor in determining your insurance premiums. Avoiding accidents and traffic violations is crucial for keeping your costs down. Safe driving not only saves you money on insurance but also keeps you and others safe on the road.

Enroll in a defensive driving course. Many insurers offer discounts for completing these courses, which can improve your driving skills and demonstrate your commitment to safe driving.

Utilizing Technology and Programs

Telematics Programs (Usage-Based Insurance)

Many insurance companies now offer telematics programs, also known as usage-based insurance. These programs use a device or app to track your driving habits, such as speed, mileage, and braking. Safe drivers can often earn significant discounts through these programs.

If you’re a consistently safe driver, consider enrolling in a telematics program. It can be a great way to demonstrate your safe driving habits and earn rewards in the form of lower premiums.

Paying Premiums Annually or Bi-Annually

Some insurers offer discounts for paying your premiums annually or bi-annually rather than monthly. While it requires a larger upfront payment, paying in less frequent installments can save you money in the long run.

If you can afford the lump sum payment, consider paying your premiums annually or bi-annually. This method can provide a simple yet effective strategy for how to lower your car insurance costs without losing coverage.

Exploring Low-Mileage Discounts

If you don’t drive frequently, you may be eligible for a low-mileage discount. Many insurers offer these discounts to drivers who log fewer miles than average. Be sure to inquire about this option if you believe you qualify.

These are practical ways to lower your car insurance costs without losing crucial coverage. Remember, saving money on car insurance shouldn’t come at the expense of your protection. By implementing these strategies, you can strike a balance between affordability and comprehensive coverage.

Comparing Car Insurance Features and Costs

| Feature | Basic Coverage | Standard Coverage | Premium Coverage |

|---|---|---|---|

| Liability Limits | State Minimum | Higher Limits | Highest Limits |

| Collision Coverage | Optional | Included | Included |

| Comprehensive Coverage | Optional | Included | Included |

| Uninsured Motorist | Included | Higher Limits | Highest Limits |

| Roadside Assistance | Optional | Optional | Included |

| Rental Reimbursement | Optional | Optional | Included |

| Approximate Cost | Lowest | Moderate | Highest |

Conclusion

Lowering your car insurance costs without sacrificing essential coverage is entirely achievable. By implementing the strategies outlined in this article, you can significantly reduce your premiums while maintaining the protection you need. Remember to shop around, compare quotes, and explore all available discounts. How to lower your car insurance costs without losing coverage is a question with many answers. Finding the right one for you may take some effort, but the savings are worth it.

Want to learn more about saving money and managing your finances? Check out our other articles on budgeting, investing, and achieving financial freedom.

FAQ about How to Lower Your Car Insurance Costs Without Losing Coverage

How can I lower my car insurance without reducing coverage?

Shop around and compare quotes from different insurance companies. Prices can vary significantly, so don’t settle for the first offer you get.

What discounts are available that I might be missing?

Ask your insurer about all possible discounts, such as good driver, multi-car, bundling (home and auto), student, military, and safety feature discounts.

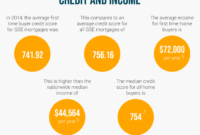

Does my credit score affect my car insurance rates?

Yes, in many states, your credit score can influence your insurance premiums. Maintaining a good credit score can help lower your rates.

How does my driving record impact my insurance costs?

A clean driving record without accidents or traffic violations demonstrates lower risk and can lead to lower insurance premiums.

Will increasing my deductible lower my premium?

Yes, a higher deductible generally means a lower premium. However, ensure you can comfortably afford the deductible if you need to file a claim.

Can taking a defensive driving course help me save money?

Many insurers offer discounts for completing approved defensive driving courses. Check with your insurer for eligible courses.

Does the type of car I drive affect my insurance rate?

Yes, safer cars with good safety ratings and anti-theft devices often qualify for lower insurance rates. Sports cars and luxury vehicles typically cost more to insure.

How does my location affect my car insurance?

Insurance rates are influenced by where you live. Areas with high rates of accidents or theft typically have higher premiums.

Can I pay my premium annually for a discount?

Some insurers offer discounts for paying your premium in full annually instead of monthly installments.

What is usage-based insurance and can it save me money?

Usage-based insurance programs monitor your driving habits using a device or app. Safe driving habits can lead to discounts. However, risky driving could increase your premium.